Your credit will play a role in what loans you qualify for and the interest rate you receive, so pull your credit and assess where you stand.

You’ll need to determine what you can comfortably afford for both your monthly and down payment. Evaluate your finances - including your debts, income, and household expenses. Here are the steps you’ll want to follow to get a mortgage and buy that dream house :

#House payment calculator utah how to

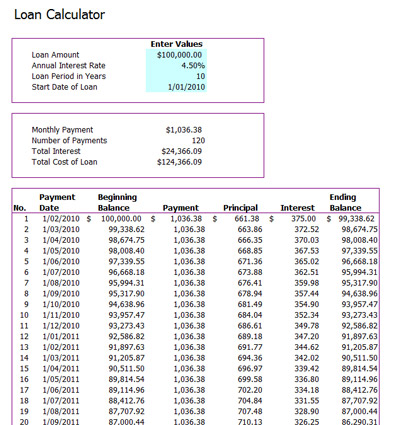

Learn: How to Buy a House: Step-by-Step GuideĪpplying for a mortgage isn’t as hard to come by as most people think. Here’s what that looks like for a 30-year, $150,000 mortgage with a 4% fixed rate: YearĪnd here’s the amortization schedule on a 15-year, $150,000 mortgage with a 4% fixed rate: Year But as years pass, more of your payment will be applied to the principal. When you begin paying off your loan, most of your payment will go toward interest.

#House payment calculator utah full

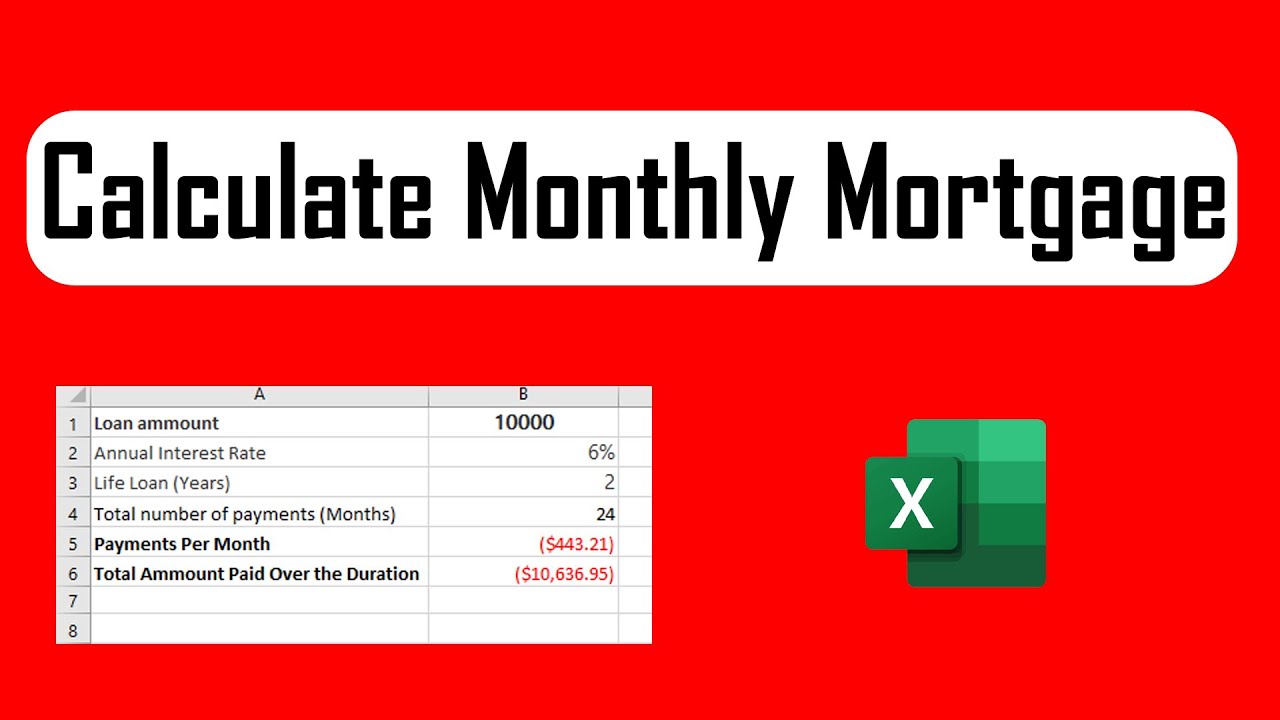

Simply fill out a short form, and you can compare loan options from all of our partners in the table below at once.Īmortization schedule on a $150,000 mortgageĪ mortgage amortization schedule helps ensure your mortgage will be paid in full when you make your last scheduled payment. From there, you could then choose your best offer and move forward with the loan process.įortunately, with Credible, there’s a more streamlined way to shop for a mortgage. You’d then receive loan estimates from each that breaks down your expected interest rate, loan costs, origination fees, any mortgage points, and closing costs. Traditionally, getting a mortgage loan would mean researching lenders, applying at three to five, and then completing the loan applications for each one. Here’s an in-depth look at what your typical monthly principal and interest payments would look like for that same $150,000 mortgage: Interest rateįind Out: How Long It Takes to Buy a House If you have an escrow account, the costs would be higher and depend on your insurance premiums, your local property tax rates, and more. See what your estimated monthly payment will be using our mortgage payment calculator below.įor a $150,000, 30-year mortgage with a 4% rate, your basic monthly payment - meaning just principal and interest - should come to $716.12. When this is the case, you’ll pay money into your escrow account monthly, too.

Escrow costs: Sometimes, your lender might require you to use an escrow account to cover property taxes, homeowners insurance, and mortgage insurance.

How much you’ll pay is indicated by your interest rate.

0 kommentar(er)

0 kommentar(er)